|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

12:37 PM

0

comments

![]()

![]()

Labels: Economy , General Market

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

4:44 PM

0

comments

![]()

![]()

Labels: General Market , International

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:02 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:42 PM

1

comments

![]()

![]()

Labels: Bond Market , Economy , General Market

The improvement in the unemployment rate earlier this month was certainly positive on the surface. The rate declined to 8.6% from the previously reported 9%. The improvement though came largely from the 300,000 individuals that simply stopped looking for a job. As a result, these additional people are not counted among the unemployed. As the below chart shows, the number individuals not in the labor continues to rise.

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:08 AM

0

comments

![]()

![]()

Labels: Economy

- Year-to-date (YTD) dividend payers in the S&P 500 have returned 1.72%, compared to the non-payers loss of 4.63%.

- The actual dividend payment YTD is up 16.2%.

- The indicated dividend rate (based on the current rate) is up 16.8% YTD, but still off 4.9% from the June 2008 high.

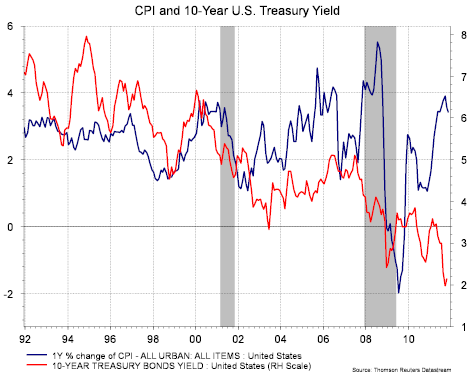

- From 1995 the S&P 500 indicated dividend yield has averaged 43% of the U.S. 10-year Treasury note, the current rate is 105%.

- 215 issues have a current yield higher than the 10-year Treasury.

Posted by

David Templeton, CFA

at

6:13 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:50 PM

0

comments

![]()

![]()

Labels: Economy

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

7:12 PM

0

comments

![]()

![]()

Labels: Economy

“the LEI is pointing to continued growth this winter, possibly even gaining a little momentum by spring. The lack of confidence has been the biggest obstacle in generating forward momentum, domestically or globally. As long as it lasts, there is a glimmer of hope.”

|

| From The Blog of HORAN Capital Advisors |

- Industrial production rose 0.7% in October

- Chicago PMI rose to 62.6 from 58.4, a seven-month high, and the new orders component rose to its highest level since March at 70.2

- The Institute for Supply Management’s (ISM) Manufacturing Index rose to 52.7, the highest level since June

- New orders increased to 56.7 from 52.4

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:32 PM

0

comments

![]()

![]()

Labels: Economy , General Market , International

“the problems in the eurozone are nothing new: too much debt from eurozone member countries to over-leveraged European financial institutions. Adding to the woes is the lack of global competitiveness among many of the zone's members, thanks to the tying of 17 vastly different economies and policies to one (too-strong) currency. The lack of a single fiscal authority within the eurozone that's capable of enforcement or supervision has allowed the problems to fester and the can to be continually kicked down the road (emphasis added).”

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:31 PM

0

comments

![]()

![]()

Labels: Economy , General Market

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

1:49 PM

1

comments

![]()

![]()

Labels: Sentiment

"The most unfortunate difference between then and now is that the euro, unlike the gold standard, is a raccoon trap: Its designers deliberately left out an exit procedure. That means you can get in, but you can’t get out without leaving a part of yourself behind. Eichengreen points out that Britain was growing again by the end of 1932, just over a year after abandoning gold under duress. Today a country—say, Greece—that quit the euro would take far longer to right itself. That’s because unlike Britain, to get relief Greece would have to default on its euro-denominated debts and damage its credit rating. "The Greek government," Eichengreen says, 'will be hard-pressed to find funds to recapitalize the banking system. Greek companies won’t be able to get credit lines. The new Greek government is going to have to print money hand over fist. At some point they would be able to push down the drachma and become more competitive. But the balance is different now.'"

Posted by

David Templeton, CFA

at

11:51 AM

0

comments

![]()

![]()

Labels: Economy , International

Posted by

David Templeton, CFA

at

9:33 AM

0

comments

![]()

![]()

Labels: General Market

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

2:54 PM

0

comments

![]()

![]()

Labels: Technicals

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:54 PM

0

comments

![]()

![]()

Labels: Economy

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:25 PM

0

comments

![]()

![]()

Labels: Dividend Analysis , Dividend Return

For the third quarter of 2011, 454 companies in the S&P 500 have reported results with 70% reporting earnings above expectations. The estimated earnings growth rate for Q3 is 17.7% according to Thomson Reuters.

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:19 PM

0

comments

![]()

![]()

Labels: General Market

Much of the volatility impacting global markets of late is the result of the European sovereign debt issues. Italy is the latest country to see its bond rates soar.

Much of the volatility impacting global markets of late is the result of the European sovereign debt issues. Italy is the latest country to see its bond rates soar. |

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

"...the debt problems facing advanced economies are even worse than we thought. Given the benefits that governments have promised to their populations, ageing will sharply raise public debt to much higher levels in the next few decades. At the same time, ageing may reduce future growth and may also raise interest rates, further undermining debt sustainability. So, as public debt rises and populations age, growth will fall. As growth falls, debt rises even more, reinforcing the downward impact on an already low growth rate. The only possible conclusion is that advanced countries with high debt must act quickly and decisively to address their looming fiscal problems. The longer they wait, the bigger the negative impact will be on growth, and the harder it will be to adjust."

Posted by

David Templeton, CFA

at

5:05 PM

0

comments

![]()

![]()

Labels: Economy , International

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:38 AM

0

comments

![]()

![]()

Labels: Economy

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

7:48 PM

0

comments

![]()

![]()

Labels: Economy , General Market