Monday, December 31, 2012

Thank You To Our Clients, Prospects And Readers Of Our Content

Posted by

David Templeton, CFA

at

4:18 PM

0

comments

![]()

![]()

Labels: General Market

Volumes Near Ten Year Low

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:19 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

Sunday, December 30, 2012

Dividend Strategies Underperform In 2012

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:21 PM

0

comments

![]()

![]()

Labels: Dividend Return , General Market

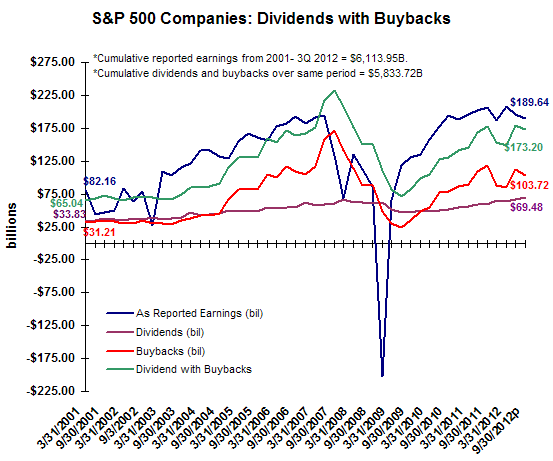

Dividend Growth More Consistent Than Buybacks In Q3 2012

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

2:18 PM

0

comments

![]()

![]()

Labels: Dividend Analysis , General Market

Saturday, December 29, 2012

A Look At The Top 1% Of Taxpayers, Government Revenues/Expenses And The Deficit

|

| From The Blog of HORAN Capital Advisors |

- "the 1.35 million taxpayers that represent the highest-earning one percent of the Americans who filed federal income tax returns in 2010 earned 18.9% of the total gross income and paid 37.4% of all federal income taxes paid in that year."

- "the 128.3 million taxpayers in the bottom 95% of all U.S. taxpayers in 2010 earned 66.2% of gross income and that group paid 40.9% of all taxes paid."

- "in other words, the top 1 percent (1.35 million) of American taxpayers paid almost as much federal income tax in 2010 ($354.8 billion) as the entire bottom 95% of American tax filers ($388.4 billion)."

- "about half (58 million) of the bottom 95% of American “taxpayers” paid nothing or got a tax refund."

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

2:34 PM

0

comments

![]()

![]()

Labels: Economy

Wednesday, December 26, 2012

A Need To Focus On Government Outlays

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:15 PM

0

comments

![]()

![]()

Labels: Economy

Saturday, December 22, 2012

Fiscal Cliff Not Resulting In Dividend Cliff

Interestingly, this potentially higher tax rate does not seem to be having a "negative" impact on the long term dividend policy for companies. Factset Research notes in their Dividend Quarterly report for Q3:

- aggregate dividends per share (“DPS”) grew 15.5% year-over-year at the end of Q3.

- the number of companies paying a dividend in the trailing twelve-month period again surpassed 400 (80% of the S&P 500 index).

- the S&P 500 also hasn’t shown a slowdown in companies initiating dividend payments. In Q3, 3.0% of non-payers “initiated” dividends, which is nearly triple the average over ten years (1.2%).

- the aggregate dividend payout ratio is 2.0% below the ten-year median, it is at its highest level (29.1% at the end of Q3) since the recession (when payout ratios were distorted by low aggregate earnings during the recession...).

- while there have been a number of companies that are signaling short-term changes in dividend policy or a shift towards more share buybacks..., a majority of companies have not yet responded, including the top ten dividend-payers in the S&P 500.

- the aggregate, forward twelve-month DPS estimate for the S&P 500 was 10% above the actual trailing twelve-month (“TTM”) payout at the end of November, which is a premium that is well above the ten-year average of 3%... Also, even when excluding the periods during the financial crisis (when forward DPS estimates fell below trailing figures), the forward consensus premium is in-line with the stabilized average starting in 2011.

Source:

Factset Dividend Quarterly (PDF)

By: Michael Amenta, Research Analyst

Facset Research

December 19, 2012

http://www.factset.com/websitefiles/PDFs/dividend/dividend_12.19.12

Factset Buyback Quarterly (PDF)

By: Michael Amenta, Research Analyst

Facset Research

December 20, 2012

http://www.factset.com/websitefiles/PDFs/buyback/buyback_12.20.12

Posted by

David Templeton, CFA

at

2:17 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Sunday, December 16, 2012

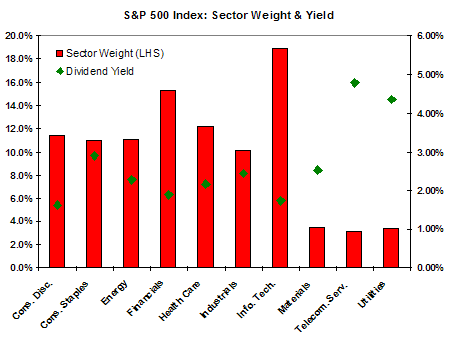

Technology Sector Largest Contributor To S&P 500 Yield

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Data Source: Standard & Poor's

Posted by

David Templeton, CFA

at

11:24 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Monday, December 10, 2012

The Arithmetic Of Equities

"Basically I am a bond guy. I like fat coupons. And I like return of principal. But I take my bonds where I can find them. And these days the place to find fat coupons and return of principal is among blue chip equities."

h/t: Market Folly

Posted by

David Templeton, CFA

at

9:26 AM

0

comments

![]()

![]()

Labels: General Market , Valuation

Another Record In Food Stamp Usage

Posted by

David Templeton, CFA

at

3:00 AM

0

comments

![]()

![]()

Labels: Economy

Sunday, December 09, 2012

Fiscal Cliff Creating A Spike In Extra Dividends

Posted by

David Templeton, CFA

at

6:28 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Saturday, December 08, 2012

Not So Golden Retirement Years Is Fallout From Weak Friday Employment Report

- those not in the labor force rose 542,000

- the civilian labor force fell by 350,000

- the number of employed declined 122,000

- discouraged workers rose 166,000, and

- the participation rate fell two tenths of a percent to 63.6%

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:50 PM

0

comments

![]()

![]()

Labels: Economy

Sunday, December 02, 2012

Implications Of An Elevated Equity Risk Premium For Asset Allocation

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:28 PM

0

comments

![]()

![]()

Labels: Asset Allocation , Economy , General Market

Saturday, December 01, 2012

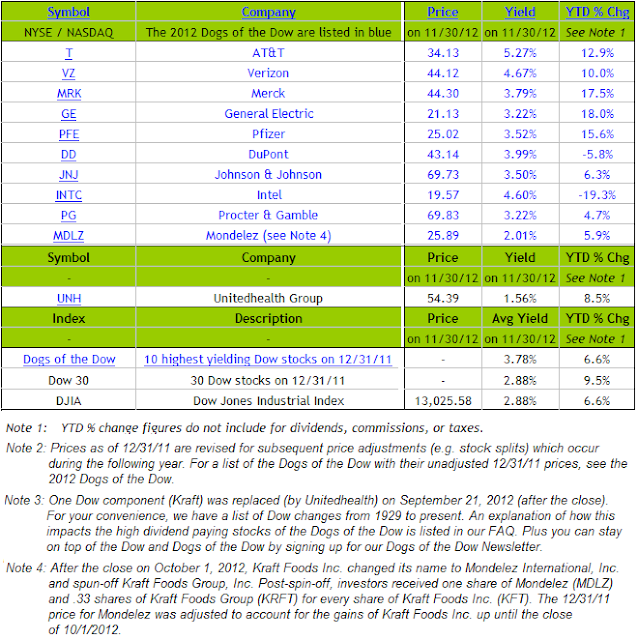

Dogs Of The Dow Performance Update

Posted by

David Templeton, CFA

at

6:33 PM

0

comments

![]()

![]()

Labels: Investments