Monday, June 26, 2017

Market Pullbacks Should Be Expected

Posted by

David Templeton, CFA

at

11:21 AM

0

comments

![]()

![]()

Labels: General Market

Sunday, June 18, 2017

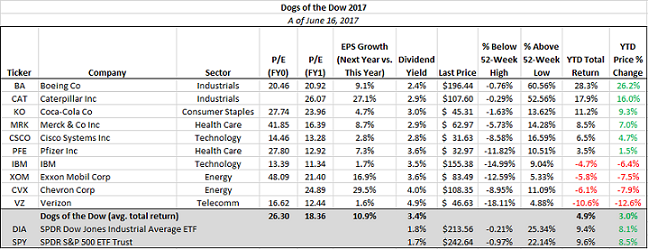

Dogs Of The Dow Underperformance Gap Widening

Posted by

David Templeton, CFA

at

7:10 PM

0

comments

![]()

![]()

Labels: General Market

Amazon: Selling And Delivering Groceries Is Not A High Margin Endeavor

- Personal Delivery: Our knowledgeable Route Sales Representative will deliver your food to your home at a time that is convenient for you.

- Drop-Off Delivery: No need to be home for delivery. We'll drop off your order at your scheduled delivery time in a reusable freezer bag that keeps your food frozen for hours.

- Mail Order: Mail Order delivery is available anywhere in the continental United States. It's a convenient option if our delivery service is not available in your area or if you want to send our food to family or friends.

Posted by

David Templeton, CFA

at

3:14 PM

0

comments

![]()

![]()

Labels: General Market

Tuesday, June 13, 2017

Growth Style Returns Dominating Value Style Returns

Posted by

David Templeton, CFA

at

3:30 AM

0

comments

![]()

![]()

Labels: General Market

Wednesday, June 07, 2017

NIPA Earnings Weakness Leads IBES S&P 500 Earnings Weakness

"SPX [S&P 500 Index] has now avoided a 5% drawdown since November 4, a period of 139 days. Since 2009, there have been only two uninterrupted uptrends that have lasted longer: 142 days (ending January 2014) and 158 days (ending September 2014). If past is prologue, then SPX appears likely to have a 5% correction before June 23 (158 days)."

Posted by

David Templeton, CFA

at

6:37 PM

0

comments

![]()

![]()

Labels: Economy , General Market

Friday, June 02, 2017

Equity Market Climbing The Proverbial Wall Of Worry

Posted by

David Templeton, CFA

at

11:18 AM

0

comments

![]()

![]()

Labels: Sentiment

Monday, May 29, 2017

The Unfortunate Rise Of The Misleading 'Scary Chart' Comparisons Again

Posted by

David Templeton, CFA

at

11:05 AM

0

comments

![]()

![]()

Labels: General Market , Technicals

Sunday, May 28, 2017

Momentum Strategy Needs A Breather

Posted by

David Templeton, CFA

at

6:01 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

Thursday, May 25, 2017

Investors Skeptical Of Stocks

Posted by

David Templeton, CFA

at

5:17 PM

0

comments

![]()

![]()

Labels: General Market , Sentiment

Thursday, May 18, 2017

Results of the "Trump Trade"

Posted by

Matt Woebkenberg

at

9:43 AM

0

comments

![]()

![]()

Monday, May 15, 2017

Momentum Strategy Leading Again

Posted by

David Templeton, CFA

at

8:59 AM

0

comments

![]()

![]()

Labels: General Market

Thursday, May 11, 2017

Brick And Mortar Retail Is A Mess At The Moment

Posted by

David Templeton, CFA

at

9:55 PM

0

comments

![]()

![]()

Labels: General Market

Saturday, May 06, 2017

Indexing Investment Strategy Becoming Increasingly More Risky?

Posted by

David Templeton, CFA

at

2:57 PM

0

comments

![]()

![]()

Labels: General Market

Friday, May 05, 2017

Higher Oil Prices Contend With Too Much Supply And Higher Energy Efficiency

Posted by

David Templeton, CFA

at

3:17 PM

0

comments

![]()

![]()

Labels: Commodities

Saturday, April 29, 2017

Credit Card Firms' Earnings Reports A Sign Of Potential Weakness With The Consumer

Capital One Financial:

- Net income fell 22% to $752 million while its earnings per share of $1.54 came in 39 cents below the average estimates of analysts. The company increased its loan loss provision by 30% year over year to $1.9 billion, as the 30-day plus delinquency rate climbed 28 basis points, to 2.92%. Meanwhile, net charge-offs rose 28% to $1.5 billion and its rate of net charge-offs to total loans increased 42 basis points to 2.5%. Most of the delinquencies and charge-offs were in the bank's credit card and auto loan portfolios (emphasis added).

- First quarter net earnings totaled $499 million or 61 cents per diluted share versus average analysts' estimates of 73 cents. Our results were impacted by the 45% increase in the provision for loan losses we experienced this quarter. The reserve build from the fourth quarter equalled $322 million. The reserve builds for the next couple of quarters are likely to be in a similar range on a dollar basis to what we saw this quarter.While most of the build continues to be driven by growth and the normalization we are seeing in the portfolio, lower recovery pricing in the quarter also drove approximately $50 million of additional reserves or 7 basis points of coverage. The net charge-off rate was 5.33% compared to 4.74% last year. we now expect NCOs to be in the 5% to low-5% range this year (emphasis added.)

- Company saw an incremental decline in recovery pricing this quarter. We believe it's driven by a combination of factors, including just the fact that you've got increased supply in the market. As charge-offs start to normalize across the industry, which we've seen, you've got that dynamic. So you've got just increased supply in the market, which we think is impacting the price.

- Total net charge-offs of $934MM increased $54MM from 4Q16. Increase driven by consumer due to seasonally higher credit card losses, while commercial charge-offs were relatively flat. Net charge-off ratio increased modestly from 4Q16 to 0.42%, but declined from 1Q16. Provision expense of $835MM increased $61MM from 4Q16, driven primarily by consumer (emphasis added.)

Supporting a leveling off for charge offs and delinquencies is the fact the household debt service ratio remains at a very low level.

Posted by

David Templeton, CFA

at

4:46 PM

0

comments

![]()

![]()

Labels: Economy

Thursday, April 27, 2017

Investor Sentiment Turns More Bullish

Posted by

David Templeton, CFA

at

10:09 AM

0

comments

![]()

![]()

Labels: Sentiment

Sunday, April 23, 2017

Dogs Of The Dow Falling Further Behind

Posted by

David Templeton, CFA

at

6:30 AM

0

comments

![]()

![]()

Labels: General Market

Saturday, April 22, 2017

Emerging Markets Poised To Outperform

Posted by

David Templeton, CFA

at

2:11 PM

0

comments

![]()

![]()

Labels: Economy , General Market , International

Friday, April 21, 2017

Brick & Mortar Retail Struggles Attributable to Growth In E-Commerce

Posted by

David Templeton, CFA

at

11:56 AM

0

comments

![]()

![]()

Labels: Economy

Friday, April 14, 2017

Widespread Bearishness Indicating Market Nearing A Turning Point?

Posted by

David Templeton, CFA

at

9:54 AM

0

comments

![]()

![]()

Labels: General Market , Sentiment , Technicals