Saturday, October 29, 2016

Bonds And Bond-Like Equities Adjusting To Higher Interest Rate Environment

Posted by

David Templeton, CFA

at

1:34 PM

0

comments

![]()

![]()

Labels: Bond Market , General Market

Thursday, October 27, 2016

U.S. Government Has A Spending Problem

Posted by

David Templeton, CFA

at

10:47 AM

0

comments

![]()

![]()

Labels: Economy

Monday, October 17, 2016

Fall 2016 Investor Letter: Time In The Market

For additional insight into our views for the market and economy, see our Investor Letter accessible at the below link.

Posted by

David Templeton, CFA

at

2:53 PM

0

comments

![]()

![]()

Labels: Newsletter

Sunday, October 16, 2016

Slow Economic Growth Has Led To Weak Job Growth

Posted by

David Templeton, CFA

at

6:24 PM

0

comments

![]()

![]()

Labels: Economy

Wednesday, October 12, 2016

Positive Equity Markets In The Year After The Presidential Election

Posted by

David Templeton, CFA

at

10:29 PM

0

comments

![]()

![]()

Labels: General Market

Sunday, October 09, 2016

Investors Rotating Out Of Income Generating Equities

"Overall, the probabilities still favor a bullish breakout to higher highs. Why is that? The combination of both the short and long-term bullish plays that remain in motion. The longer-term double bottom breakout play targeting S&P 2365 remains in play. While price has seemingly stalled out over the past seven weeks, there has not been any significant roll back either other than the -3% throwback retest last month that successfully tested and held support. All that is needed now is to take out the August highs and start acquiring the numerous bullish target objectives."

Posted by

David Templeton, CFA

at

7:57 PM

0

comments

![]()

![]()

Labels: General Market , Sentiment , Technicals

Saturday, October 08, 2016

Why We Sold Tyson Foods In September

Posted by

David Templeton, CFA

at

3:04 PM

0

comments

![]()

![]()

Labels: General Market , Valuation

Friday, October 07, 2016

Inspite Of Decline In Buybacks, Aggregate 'As Reported Earnings' Continue To Increase

- Cash reserves also set a new record for the second consecutive quarter, as S&P 500 Industrial (Old), which consists of the S&P 500 less Financials, Transportations and Utilities, available cash and equivalent now stands at $1.374 trillion, up 2.0% from the prior record of $1.348 trillion. The current cash level is 86 weeks of expected 2016 operating income (the same as was posted for Q1 2016), giving corporations leeway in their expenditures.

- “Shareholder returns continue to be strong, even as the quarter ticked down from last quarter’s record, Cash has increased to a record, as low-cost financing globally remains plentiful."

- "The rate of dividend increases continues to slow across sector lines, as income investors remain limited in their alternatives. Base buyback expenditures, those used to negate stock options, may need to increase in Q3 2016 to compensate for higher share prices. Discretionary buybacks, used to reduce share count and increase EPS, remain the main unknown.”

Posted by

David Templeton, CFA

at

2:49 PM

0

comments

![]()

![]()

Labels: Dividend Analysis , General Market

Sunday, October 02, 2016

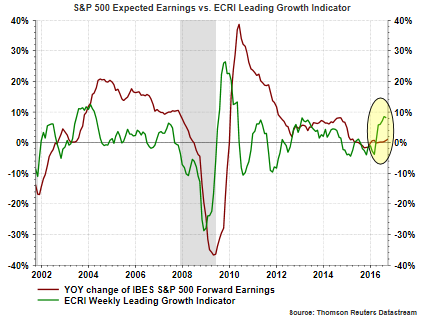

More Signs Of An Earnings Recovery Unfolding

Posted by

David Templeton, CFA

at

11:03 AM

0

comments

![]()

![]()

Labels: Economy , General Market

Sunday, September 25, 2016

The Risk Of Dismissing The Data: The TED Spread And Baltic Dry Index

Posted by

David Templeton, CFA

at

5:17 PM

0

comments

![]()

![]()

Labels: Economy , International , Technicals

Thursday, September 22, 2016

Sentiment: Investors Not Believing The Rally

Posted by

David Templeton, CFA

at

10:06 AM

0

comments

![]()

![]()

Labels: Sentiment

Monday, September 19, 2016

Heightened Market Volatility Would Favor Low Volatility Strategy, But It Looks Expensive

Posted by

David Templeton, CFA

at

4:30 AM

0

comments

![]()

![]()

Labels: General Market

Sunday, September 11, 2016

The Dogs Of The Dow And The Risk With Exchange Traded Notes

Posted by

David Templeton, CFA

at

2:37 PM

0

comments

![]()

![]()

Labels: General Market

Friday, September 09, 2016

Transports Leading Industrials A Bullish Market Signal

Posted by

David Templeton, CFA

at

9:56 AM

0

comments

![]()

![]()

Labels: General Market , Technicals

Friday, September 02, 2016

Another Month Of Equity Outflows

Posted by

David Templeton, CFA

at

9:53 PM

0

comments

![]()

![]()

Labels: General Market , Sentiment

Sunday, August 28, 2016

Higher Oil Prices Must Contend With Too Much Inventory

Posted by

David Templeton, CFA

at

5:54 PM

0

comments

![]()

![]()

Labels: Commodities , General Market

Saturday, August 27, 2016

Income Focused Investments Continue To Show Weakness

Posted by

David Templeton, CFA

at

3:19 PM

0

comments

![]()

![]()

Labels: Dividend Return , Economy , General Market

Monday, August 22, 2016

What A Difference A Day Makes: The Calendar Roll

This same impact is resulting in large spikes in the one year rolling return for energy as energy prices were in the upper $30 range versus today's $47.41. As time moves forward to year end, energy was falling into the mid $20/bbl area and if oil prices stay near current levels, the year over year price increase will be significant, nearly a doubling of the price of oil.

Posted by

David Templeton, CFA

at

10:31 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

Saturday, August 20, 2016

Some Favorable Market Technicals But Awaiting A Resumption Of Earnings Growth

Posted by

David Templeton, CFA

at

6:03 PM

0

comments

![]()

![]()

Labels: General Market , Sentiment , Technicals

Friday, August 19, 2016

Highlights From S&P Dow Jones Indices Dividend Aristocrats Update

Posted by

David Templeton, CFA

at

8:51 PM

0

comments

![]()

![]()

Labels: Dividend Analysis