- How the Stock Market Destroyed The Middle Class (MarketWatch)

- Stock Buybacks Are Killing the American Economy (The Atlantic)

- Profits Are Up, But Wages Are Stagnant. This Senator Has A Plan (ThinkProgress)

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

1:59 PM

0

comments

![]()

![]()

Labels: Economy

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

"The string of inventory builds continues for oil, up a fat 5.3 million barrels in the April 17 week to 489.0 million which is the 14th straight build and yet another 80-year high [emphasis added]. The build is due to yet another rise in oil imports and also in part to an easing of refinery demand for oil. But refineries are still busy, operating at 91.2 percent of capacity."

Posted by

David Templeton, CFA

at

9:02 AM

0

comments

![]()

![]()

Labels: Commodities

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

2:16 PM

0

comments

![]()

![]()

Labels: Newsletter

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:51 PM

0

comments

![]()

![]()

Labels: Dividend Return , General Market

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

8:56 PM

0

comments

![]()

![]()

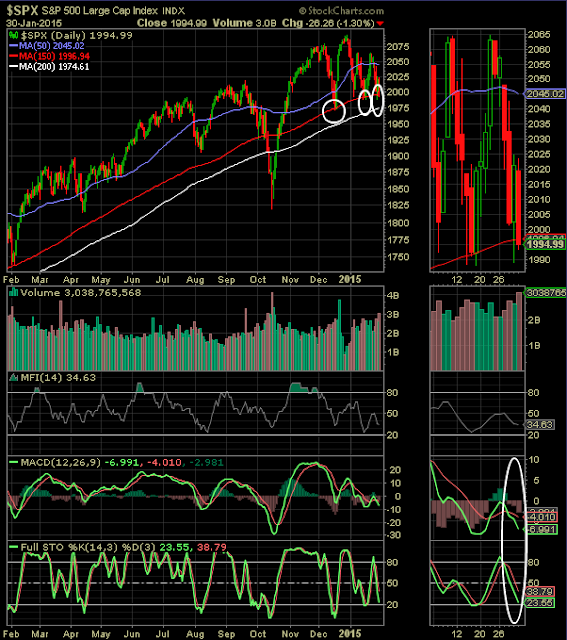

Labels: General Market , Technicals

"The Citigroup Economic Surprise Indices are objective and quantitative measures of economic news. They are defined as weighted historical standard deviations of data surprises (actual releases vs Bloomberg survey median). A positive reading of the Economic Surprise Index suggests that economic releases have on balance [been] beating consensus. The indices are calculated daily in a rolling three-month window. The weights of economic indicators are derived from relative high-frequency spot FX impacts of 1 standard deviation data surprises. The indices also employ a time decay function to replicate the limited memory of markets."

"It is important to understand, though, that the surprise index doesn’t rise or fall with the ebb and flow of the economic cycle. Because it measures a rolling average of how things turn out relative to forecasts, more often than not it tends to turn negative after there has been a streak of encouraging economic news, such as in late 2014. This is because forecasters often mistakenly extrapolate recent trends."

"When the index is deeply negative, as it is today, that is usually a good sign for stocks. Following the weakest 5% of observations since 2003, the S&P 500 rose by 14.4%, on average, during the following six months. Conversely, it rose by just 5.5% following times when the surprise index was highest."

"Today’s trough puts the index in the lowest 8% of readings. This is unusual given stocks are within spitting distance of all-time highs, despite softer-than-expected economic reports."

"The possible reason for this revolves around the Federal Reserve, which may be just months away from raising interest rates for the first time in nine years. News that is disappointing enough to sow doubt in rate setters’ minds without signaling a recession is seen as ideal for stock prices."

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

"Jack Ablin, chief investment officer of BMO Private Bank in Chicago, said he pays attention to the surprise indexes as a way to gauge when a particular national economy may be turning and looks for good value in equities.

|

| From The Blog of HORAN Capital Advisors |

It is an early indication of a momentum shift," he said, "adding that he's been raising the amount of money put into international stocks. While Ablin expects moderate U.S. growth, he said a strong U.S. dollar has the potential to dampen the expansion."

Posted by

David Templeton, CFA

at

1:20 PM

0

comments

![]()

![]()

Labels: Economy , General Market

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

- "During the course of the first quarter, the dollar strengthened relative to the euro. On December 31, one euro was equal to $1.21 dollars. On March 31, one euro was worth about $1.07 dollars."

- "The dollar has also strengthened relative to year-ago values for both the euro and the yen. In the year ago quarter (Q1 2014), one euro was equal to $1.37 dollars on average. For Q1 2015, one euro was equal to $1.13 dollars on average. In the year-ago quarter (Q1 2014), one dollar was equal to $102.76 yen on average. For Q1 2015, one dollar has been equal to $119.17 yen on average."

Posted by

David Templeton, CFA

at

12:44 PM

0

comments

![]()

![]()

Labels: General Market

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:29 PM

0

comments

![]()

![]()

Labels: General Market , International

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:07 PM

0

comments

![]()

![]()

Labels: Dividend Return

- "More issues reduced their share count this quarter than last, with 308 doing so in Q4, up from 257 in Q3 and 276 in Q4 2013."

- "Significant changes (generally considered 1% or greater for the quarter) continued to strongly favor reductions, and also increased, as 117 issues reduced their share count by at least 1%, compared to last quarter’s 101 and the 112 which did so in Q4 2013."

- "Share reduction change impacts of at least 4% (Q4 2014 over Q4 2013), which can be seen in EPS comparisons, were flat at 99 in Q4 2014 from Q3, but up from the 83 posted in Q4 2013."

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

1:29 PM

0

comments

![]()

![]()

Labels: Dividend Analysis , General Market

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:43 AM

0

comments

![]()

![]()

Labels: Sentiment

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

11:59 AM

0

comments

![]()

![]()

Labels: Technicals

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:16 AM

0

comments

![]()

![]()

Labels: General Market , Sentiment , Technicals

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

12:50 PM

0

comments

![]()

![]()

Labels: General Market , Valuation

"The Dow just made another all-time record high. To provide some further perspective to the current Dow rally, all major market rallies of the last 115 years are plotted on today's chart. Each dot represents a major stock market rally as measured by the Dow with the majority of rallies referred to by a label which states the year in which the rally began. For today's chart, a rally is being defined as an advance that follows a 30% decline (i.e. a major bear market). As today's chart illustrates, the Dow has begun a major rally 13 times over the past 115 years which equates to an average of one rally every 8.8 years. It is also interesting to note that the duration and magnitude of each rally correlated fairly well with the linear regression line (gray upward sloping line). As it stands right now, the current Dow rally that began in March 2009 (blue dot labeled you are here) would be classified as below average in both duration and magnitude."

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

1:40 PM

0

comments

![]()

![]()

Labels: General Market

|

| From The Blog of HORAN Capital Advisors |

"By closing above swing resistance at S&P 2064 today, a new smaller bullish range breakout setup with a target at S&P 2141 has now triggered. Today’s rally also further developed the handle on the new cup setup we talked about in yesterday’s report and which you can also see in the 30 minute view below but needs to trade above last Friday’s intraday high at S&P 2072 to fire."

|

| From The Blog of HORAN Capital Advisors |

"With the attempted small range breakout in motion, it is now important that we see sustained bullish upside follow through to confirm. The first step would be to clear and hold above last Friday’s high at S&P 2072 and then take out the prior early December swing high at S&P 2079. If those levels are broken all that would remain is the December high at S&P 2093. If we are to now move away from this multi-month trading range, we will need to see sustained bullish upside follow through. In sum, this is the bulls’ best chance yet to try to put this trading range behind it. Whether it can hold above the smaller range is key."

Posted by

David Templeton, CFA

at

11:06 PM

2

comments

![]()

![]()

Labels: Technicals

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

"The trailing price-to-earnings ratio of the index is at 22.7, which is 40 percent more than its long-term average of 16.2. Its price-to-sales ratio of 1.6 is nearly 67 percent higher than its long-term average."

Posted by

David Templeton, CFA

at

9:54 AM

0

comments

![]()

![]()

Labels: Asset Allocation , General Market , International , Investments

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

"Consumer sentiment held on to its very strong surge at the beginning of the month, ending January at 98.1 vs the mid-month reading of 98.2 and compared against 93.6 in December. The current conditions component extended its first half gain to 109.3 vs 108.3 at mid-month and against 104.8 in December. The comparison with December points to strength for January consumer activity. The expectations component ends January at 91.0 vs 91.6 at mid-month and 86.4 in December. Price expectations are low, at 2.5 percent for 1-year expectations, up 1 tenth from mid-month but down 3 tenths from December, while 5-year expectations remain at 2.8 percent, unchanged from both mid-month and December. Consumer spirits are now very strong but have yet to translate to a similar pickup in consumer spending."

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:53 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:13 AM

2

comments

![]()

![]()

Labels: Commodities

|

Posted by

David Templeton, CFA

at

8:03 AM

0

comments

![]()

![]()

Labels: Newsletter