|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:40 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

Posted by

David Templeton, CFA

at

9:32 AM

0

comments

![]()

![]()

Labels: Week Ahead

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:20 PM

0

comments

![]()

![]()

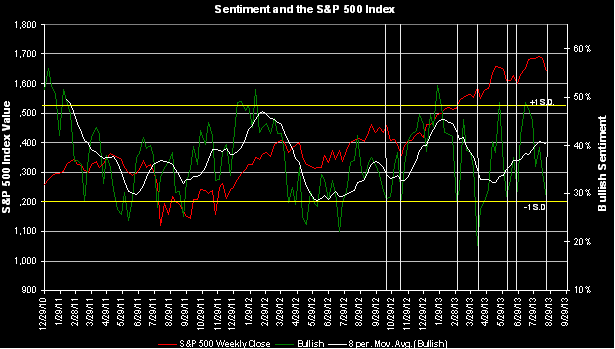

Labels: Sentiment

It has been some time since I have seen so many market strategist laser focused on the fact the market has topped out and appears to be rolling over. It isn't a frequent occurrence when strategist make perfect market timing calls. Certainly there is a great deal to worry about as we move into the second half of August and then the notoriously poor market months of September and October. Jackson Hole is this week, Fed tapering remains on the table, approaching elections in Germany in September, the need for Congress to deal with the debt ceiling all of which are enough to knock the life out of the bulls. Of concern to many, and rightfully so, is the fact this market seems to have moved higher unabated since the end of the financial crisis. Below are a few of the articles we have reviewed in advance of the coming week.

Posted by

David Templeton, CFA

at

12:05 PM

0

comments

![]()

![]()

Labels: Week Ahead

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

12:35 PM

2

comments

![]()

![]()

Labels: General Market

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

There is a structural factor, the increasing importance of multinational corporations, that seems to be important because of the current taxation of the income generated abroad that domestic corporations bring back to the U.S. Here, fiscal policy may be playing an undesirable role, and its modification in the coming years could boost domestic investment and help overcome the slow recovery from the Great Recession.

There is also another role for fiscal policymakers in the near future. Although the magnitude of the effect is not clear, it seems that designing and communicating a long-run plan to deal with the increasing fiscal deficit would reduce uncertainty about future taxes, reduce abnormal cash holdings and potentially favor private investment.

Posted by

David Templeton, CFA

at

10:21 AM

0

comments

![]()

![]()

Labels: Economy , General Market

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

11:55 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

"The market always worries - or shall we say the traders and investors that comprise the market always worry. Worry, worry, worry - if you have money on the line then worry becomes part of your DNA.

This morning retail sales print stronger than expected and immediately the worry is the Fed will pull QE in September or at least start shutting down the program. Let's worry shall we.

I don't mean to sound nonchalant about the possibilities but Wall Street (read investors and traders) do not like anything that resembles uncertainty and with everyone of the belief that quantitative easing is the only reason this market is at these highs, well you can understand the reason for worry.

I can remember a time not so long ago where "bad news" was good as was" good news". It almost feels as if we are shifting to "good news" is bad as is "bad news". The glass is half empty - not half full.

The next few weeks look to be challenging as the uncertainty is set to grow - not diminish. Elections in Germany, QE going away, budget battles looming, etc. You can see the uncertainties growing and that is likely to bring volatility and pressure on these markets. That pressure is actually needed for it will lead to tests that let us measure and measurement is how we determine what is next."

Posted by

David Templeton, CFA

at

10:36 PM

0

comments

![]()

![]()

Labels: General Market , International

Starting this weekend, on Sunday, we will attempt to provide links to a few articles we read last week and article links we believe our readers might find of interest for the week ahead. Below are the links for our initial list.

Posted by

David Templeton, CFA

at

1:17 PM

0

comments

![]()

![]()

Labels: Week Ahead

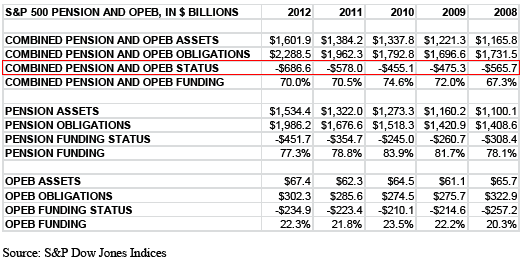

"...the amount of assets that S&P 500 companies set aside to fund pensions and OPEB amounted to $1.60 trillion in 2012, covering $2.29 trillion in obligations with the resulting underfunding equating to $687 billion, or a 70.0% overall funding rate."

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:30 PM

0

comments

![]()

![]()

Labels: General Market

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:43 PM

0

comments

![]()

![]()

Labels: General Market , International

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:38 AM

0

comments

![]()

![]()

Labels: General Market , Technicals

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:55 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

1:57 PM

0

comments

![]()

![]()

Labels: Newsletter

In the below video Warren Buffett provides his take on stocks and the market. A couple of key points he mentions are:

Posted by

David Templeton, CFA

at

1:12 PM

0

comments

![]()

![]()

Labels: General Market

"The Dow just made another post-financial crisis rally high. To provide some further perspective to the current Dow rally, all major market rallies of the last 112 years are plotted on today's chart. Each dot represents a major stock market rally as measured by the Dow with the majority of rallies referred to by a label which states the year in which the rally began. For today's chart, a rally is being defined as an advance that follows a 30% decline (i.e. a major bear market). As today's chart illustrates, the Dow has begun a major rally 13 times over the past 112 years which equates to an average of one rally every 8.6 years. It is also interesting to note that the duration and magnitude of each rally correlated fairly well with the linear regression line (gray upward sloping line). As it stands right now, the current Dow rally that began in March 2009 (blue dot labeled you are here) would be classified as well below average in both duration and magnitude. However, when compared to the most recent post-major bear market rally (i.e. the rally that began in 2002), the current rally is significantly greater in magnitude and accomplished this feat in less time."

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:30 AM

0

comments

![]()

![]()

Labels: General Market

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:42 PM

0

comments

![]()

![]()

Labels: General Market , International

|

| From The Blog of HORAN Capital Advisors |

“Dividends continued to increase in the second quarter with actual cash payments increasing 15.5% and the forward indicated dividend setting another all-time high. Payout rates, which historically average 52%, continue to remain near their lows at 36%. At this point, year-to-date dividend payments are up 13.9%, with 2013 easily expected to surpass the 2012 record dividend payment.”

Posted by

David Templeton, CFA

at

9:46 PM

0

comments

![]()

![]()

Labels: Dividend Analysis , Dividend Return

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

1:11 PM

0

comments

![]()

![]()

Labels: Economy , General Market

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:51 PM

1

comments

![]()

![]()

Labels: General Market , International