To our clients and readers, we wish all of you a Healthy and Prosperous New Year.

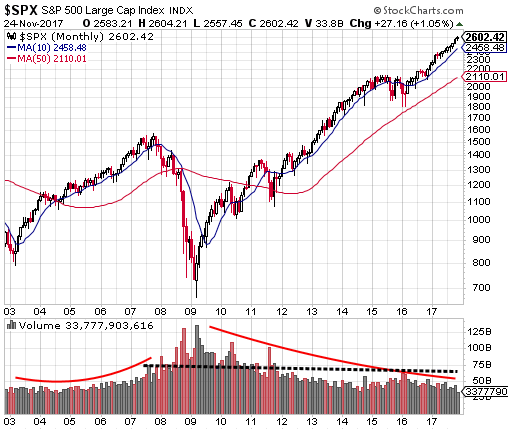

Second Longest S&P 500 Rally Since 1932 - January 25, 2017

Recent Outperformance Of Low Volatility A Sign Of Risk Off Ahead? - February 12, 2017

Time To Reduce One's Equity Exposure? - March 1, 2017

Widespread Bearishness Indicating Market Nearing A Turning Point? - April 14, 2017

The Unfortunate Rise Of The Misleading 'Scary Chart' Comparisons Again - May 29, 2017

Market Pullbacks Should Be Expected - June 26, 2017

Strong Earnings Growth And Favorable Valuations Lead To Weak Stock Returns - July 22, 2017

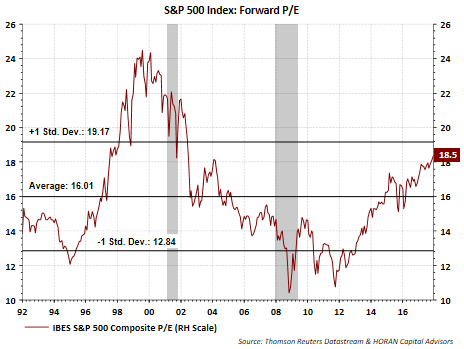

The S&P 500 Index Is Expensive And Has Mostly Been So Since The Early 1990's - August 5, 2017

Stocks Need Some Healthy Competition - September 16, 2017

Citgroup Economic Surprise Indices Have Little Bearing On Equity Market Performance - October 15, 2017

Individual And Investment Manager Sentiment Is Diverging - November 2, 2017

If Cash Is King - December 19, 2017