Posted by

David Templeton, CFA

at

8:25 PM

0

comments

![]()

![]()

Labels: General Market

"The most dangerous thing an investor can do is overreact in this kind of market," says Rick Adkins, a certified financial planner with Arkansas Financial Group. Instead of panic selling when share prices are plunging, wait a few days until you can make a rational decision to sell, not an emotional one.

Reasons not to sell are often forgotten at times of market turmoil. For one, many institutional investors are "looking to tap the irrational behavior of the individual investor," says Adkins. That means savvy money managers may be waiting to gobble up the shares you sold at bargain prices. That seems to be what happened earlier this week, when Janus Capital Corp. and others began buying stocks voraciously around midday Tuesday.

...In the last decade or so, the stock market has usually rebounded within days of a big sell-off. You can't count on a fast snap-back every time, of course. But if you start dumping shares, odds are you'll buy them back later at a higher price. (emphasis added) "If you thought that the stock you bought was good value yesterday, it's likely to be a good value today unless something fundamental has changed in the company's prospects," says Harold Evensky, a partner with Evensky, Brown & Katz, a financial planning firm.

“There are very attractive opportunities now,” says Bill Stromberg, director of global equities and of global equity research. “Companies in the heartland of industrial America, many technology companies, and many health care companies are thriving in this environment and reporting pretty good earnings. We’re trying to take advantage of widespread selling to pick them up cheap.

Stephen Wetzel, a financial planner and adjunct professor of financial planning at New York University, is far less circumspect. "I'm buying like a crazy man: value stocks, financial services, value funds, muni bonds, some international small cap. You don't get opportunities like this very often."

Posted by

David Templeton, CFA

at

2:35 PM

0

comments

![]()

![]()

Labels: General Market

(The following article was originally published on The DIV-Net website on November 2, 2008)

Posted by

David Templeton, CFA

at

5:30 AM

0

comments

![]()

![]()

Labels: General Market

It is not uncommon for global markets to become more correlated in severe bear markets. Maybe this higher correlation will be a positive when markets begin to recover?

It is not uncommon for global markets to become more correlated in severe bear markets. Maybe this higher correlation will be a positive when markets begin to recover?

Posted by

David Templeton, CFA

at

10:39 PM

0

comments

![]()

![]()

Labels: General Market

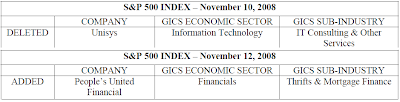

Today Standard & Poor's announced Unisys Corp. (UIS) would be replaced in the S&P 500 Index by People’s United Financial Inc. (PBCT). The UIS will be removed after the close of trading on November 10th and PBCT will be added after the close of trading on November 12th. Could this be a contrarian indicator indicating more favorable returns for technology?

Posted by

David Templeton, CFA

at

7:22 PM

0

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

8:24 AM

0

comments

![]()

![]()

Labels: Sentiment

Posted by

David Templeton, CFA

at

9:03 PM

0

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

10:19 PM

0

comments

![]()

![]()

Labels: Dividend Return

Posted by

David Templeton, CFA

at

10:01 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

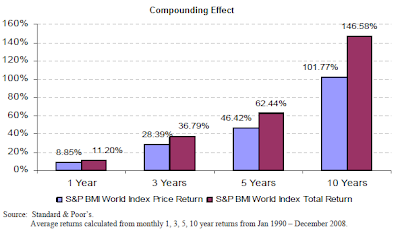

- Historically, dividends have contributed nearly one-third of the equity return of the S&P BMI World Index, while capital appreciation has contributed approximately two-thirds.

- When bond yields are low, income oriented investors can switch to dividend paying stocks to enhance current income.

- Dividends allow investors to capture the upside potential while providing downside protection in the down markets.

Lastly, the compounding of dividends adds significantly to the total return of ones investment. For the 18-year period from January 1990 to December 2008 the price only return for the S&P BMI World Index totaled 101.77% versus the total return (dividends included) on the World Index over that same time period of 146.58%.

Lastly, the compounding of dividends adds significantly to the total return of ones investment. For the 18-year period from January 1990 to December 2008 the price only return for the S&P BMI World Index totaled 101.77% versus the total return (dividends included) on the World Index over that same time period of 146.58%.

Posted by

David Templeton, CFA

at

1:38 PM

0

comments

![]()

![]()

Labels: Dividend Analysis , Dividend Return

Posted by

David Templeton, CFA

at

12:36 PM

0

comments

![]()

![]()

Labels: Investments

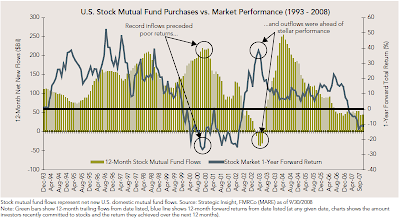

It has been said a number of times in this recent market environment, that the best time to buy stocks is when it feels the most uncomfortable. October made this difficult to believe given the punishment the market took in that month. In fact, Friday's (10/31/08) positive market advance was the first time the Dow Jones Industrial Average recorded two consecutive up days since September 26th.

It has been said a number of times in this recent market environment, that the best time to buy stocks is when it feels the most uncomfortable. October made this difficult to believe given the punishment the market took in that month. In fact, Friday's (10/31/08) positive market advance was the first time the Dow Jones Industrial Average recorded two consecutive up days since September 26th.

Posted by

David Templeton, CFA

at

12:41 PM

0

comments

![]()

![]()

Labels: General Market , Investments

Detail on the individual aristocrats is accessible in the below spreadsheet. The full aristocrats spreadsheet is viewable by clicking the Aristocrats link.

Detail on the individual aristocrats is accessible in the below spreadsheet. The full aristocrats spreadsheet is viewable by clicking the Aristocrats link.

Posted by

David Templeton, CFA

at

10:39 AM

1

comments

![]()

![]()

Labels: Dividend Return

Posted by

David Templeton, CFA

at

10:01 PM

1

comments

![]()

![]()

Labels: Dividend Return , General Market

Posted by

David Templeton, CFA

at

8:30 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

11:22 AM

1

comments

![]()

![]()

Labels: Dividend Analysis

- Mr. Obama would roll back the 2001 and 2003 tax cuts for taxpayers in the top two brackets, raising the top two marginal rates of income tax to 36% and 39.6% from 33% and 35%. The 33% rate begins to hit this year at incomes of $164,550 for an individual and $200,300 for joint filers.

- If you're an individual with taxable income of $164,550, you will pay more taxes.

Mr. Obama's most dramatic departure from current tax policy is his promise to lift the cap on income on which the Social Security payroll tax is applied.... it's unclear if that higher rate would apply to the employee, the employer, or both.

Posted by

David Templeton, CFA

at

8:18 AM

2

comments

![]()

![]()

Labels: Economy , General Market

(I originally posted an article on the VIX Index on The DIV-Net website on October 19, 2008)

since the VIX Index introduction in 1993, VIX has been considered by many to be the world’s premier barometer of investor sentiment and market volatility. The VIX Index is an implied volatility index that measures the market’s expectation of 30-day S&P 500® volatility implicit in the prices of near-term S&P 500 options. VIX is quoted in percentage points, just like the standard deviation of a rate of return.

Additionally, one of the most interesting features of VIX, and the reason it has been called the “investor fear gauge,” is that, historically, VIX hits its highest levels during times of financial turmoil and investor fear. As markets recover and investor fear subsides, VIX levels tend to drop. This effect can be seen in the below chart in the VIX behavior isolated during the Long Term Capital Management and Russian Debt Crises in 1998.

(click chart for larger image)

Posted by

David Templeton, CFA

at

5:30 AM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

12:00 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

A couple of recent posts highlighted below, indicate a market bottom could be forming.

- This suggests accumulation and could suggest a complex bottoming formation is occurring, particularly when one looks at the recent extremes in sentiment data.

Posted by

David Templeton, CFA

at

9:59 AM

0

comments

![]()

![]()

Labels: General Market