- Surprise! Higher Dividends = Higher Earnings Growth (pdf), by Robert D Arnott and Clifford S. Asness.

- As noted below, the article concludes future earnings growth is highest for the firms that have high current payout ratios. The article does offer the caution that an investor needs to determine if a company with a high payout ratio can maintain the dividend at the current high rate.

- "We investigate whether dividend policy, as observed in the payout ratio of the U.S. equity market portfolio, forecasts future aggregate earnings growth. The historical evidence strongly suggests that expected future earnings growth is fastest when current payout ratios are high and slowest when payout ratios are low. This relationship is not subsumed by other factors, such as simple mean reversion in earnings. Our evidence thus contradicts the views of many who believe that substantial reinvestment of retained earnings will fuel faster future earnings growth. Rather, it is consistent with anecdotal tales about managers signaling their earnings expectations through dividends or engaging, at times, in inefficient empire building. Our findings offer a challenge to market observers who see the low dividend payouts of recent times as a sign of strong future earnings to come."

- Estimating the Long-Term Return on Stocks by John P. Hussman, Ph. D.

- The article provides an analysis similar to the yield to maturity (YTM) calculation for bonds. The Hussman article contains a formula an investor can use to determine YTM for stock investments.

"...For stocks, the "yield-to-maturity" comes from two components: income plus capital gain. The income component is simply the dividend yield. Assume initially that the dividend yield is held constant over time...If the dividend yield (Dividend/Price) is constant, then by definition, prices must grow at exactly the same rate as dividends grow. By definition, when the dividend yield is unchanged between the date you buy stocks and the date you sell them, your total return equals the dividend yield (income) plus the growth rate of dividends (capital gain)."

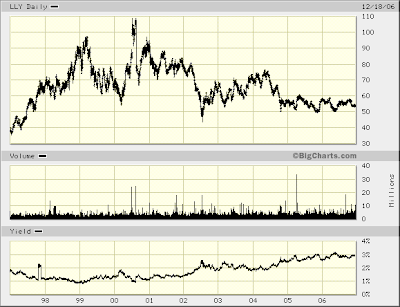

- High Dividend Stocks: Bonds with Price Appreciation? This article is Chapter 2 of the book Investment Fables by Aswath Damodaran, Ph. D., a professor at New York University.