Saturday, October 28, 2017

Sizable Declines In A Few Individual Stocks; Time To Review Allocations

Posted by

David Templeton, CFA

at

2:33 PM

0

comments

![]()

![]()

Labels: Economy , Education , International

Saturday, September 05, 2015

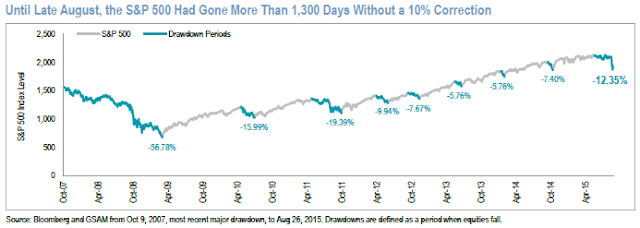

Market Timing Risk

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

5:21 PM

0

comments

![]()

![]()

Labels: Education , General Market

Sunday, July 07, 2013

Women And Investing

Posted by

David Templeton, CFA

at

3:21 PM

0

comments

![]()

![]()

Labels: Education , Financial Planning , General Market

Wednesday, May 09, 2012

Earned Success Or Learned Helplessness: Choosing A College Degree

We are entering that time of year where students are celebrating their graduation from high school and college. Having recently attended Indiana University's graduation and talking with some of the graduates, it was evident that not all seniors were successful in securing a job. Prior to the IU graduation, I attended the academic signing day at the high school in our community. The academic signing is where the top graduating seniors, i.e., those achieving a 4.0 or higher grade point average during their 4-years of high school, announce their college choice and intended major. The common thread for both functions I attended is the selection of ones major is an important decision and can significantly impact one's marketability upon graduating from college.

"Many of you [college graduates] have been reared on the cliché that the purpose of education isn't to stuff your head with facts but to teach you how to think. Wrong. I routinely interview college students, mostly from top schools, and I notice that their brains are like old maps, with lots of blank spaces for the uncharted terrain. It's not that they lack for motivation or IQ. It's that they can't connect the dots when they don't know where the dots are in the first place."

"In every generation there's a strong tendency for everyone to think like everyone else. But your generation has an especially bad case, because your mass conformism is masked by the appearance of mass nonconformism. It's a point I learned from my West Point intern, when I asked her what it was like to lead such a uniformed existence.

Her answer stayed with me: Wearing a uniform, she said, helped her figure out what it was that really distinguished her as an individual."

"The link between earned success and life satisfaction is well established by researchers. The University of Chicago's General Social Survey, for example, reveals that people who say they feel "very successful" or 'completely successful' in their work lives are twice as likely to say they are very happy than people who feel 'somewhat successful.' It doesn't matter if they earn more or less income; the differences persist.

The opposite of earned success is 'learned helplessness,' a term coined by Martin Seligman, the eminent psychologist at the University of Pennsylvania. It refers to what happens if rewards and punishments are not tied to merit: People simply give up and stop trying to succeed.

Learned helplessness was what my wife and I observed then, and still do today, in social-democratic Spain. The recession, rigid labor markets, and excessive welfare spending have pushed unemployment to 24.4%, with youth joblessness over 50%. Nearly half of adults under 35 live with their parents. Unable to earn their success, Spaniards fight to keep unearned government benefits.

Meanwhile, their collective happiness—already relatively low—has withered. According to the nonprofit World Values Survey, 20% of Spaniards said they were "very happy" about their lives in 1981. This fell to 14% by 2007, even before the economic downturn.

That trajectory should be a cautionary tale to Americans who are watching the U.S. government careen toward a system that is every bit as socially democratic as Spain's.

Government spending as a percentage of GDP in America is about 36%—roughly the same as in Spain. The Congressional Budget Office tells us it will reach 50% by 2038. The Tax Foundation reports that almost 70% of Americans take more out of the tax system than they pay into it. Meanwhile, politicians foment social division on the basis of income inequality, instead of attempting to improve mobility and opportunity through education reform, pro-growth policies, and an entrepreneur-friendly economy.

These trends do not mean we are doomed to repeat Spain's unhappy fate. But our system of earned success will not defend itself."

Posted by

David Templeton, CFA

at

12:10 AM

0

comments

![]()

![]()