It is hard not to look at much of the recent economic data and not come to the conclusion a V-shaped recovery seems to be unfolding. Certainly many of the reports are coming off depressed levels; however, a sharp recovery is occurring nonetheless. Today's nonfarm payroll number is another example with a month over month increase of 4.8 million versus a consensus expectation of 3.0 million increase.The labor market still needs healing, but payrolls are up 8 million in two months.

Stating the obvious, but the stay at home mandates and business shutdowns caused a severe economic contraction yet consumer sentiment has remained at a relatively high level. The Conference Board's June Consumer Confidence Index was reported at 98.1. At the worst of the financial crisis in 2008/2009 consumer confidence fell to 25.3. The government's monetary and fiscal support, which includes an extra $600 in weekly unemployment benefit payment has help to maintain the financial health of many consumers and likely contributing to better consumer confidence.

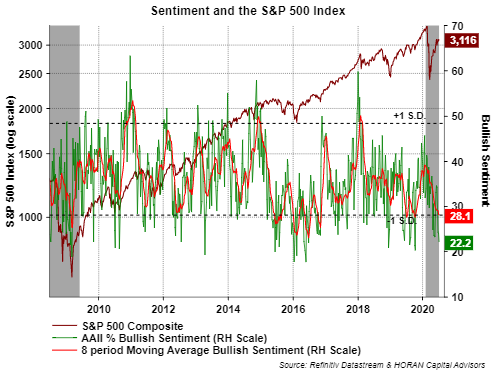

And finally, a lot of positive data keeps unfolding, yet individual investors are far from expressing bullishness for stocks. Today's AAII sentiment survey release reported bullish investor sentiment declined another two percentage points to 22.2% as seen in the below chart. This brings the 8-period moving average of the bullishness reading down to 28.1%, the lowest level since mid October last year. Yet, through the July 2 close, the S&P 500 Index is up 39.89% from the March 23 low and down just 3.12% year to date. This recovery has occurred during a period where the 8-period bullish investor sentiment reading has mostly declined from the mid 30's level to 28.11 today. The market climbing the proverbial wall of worry.

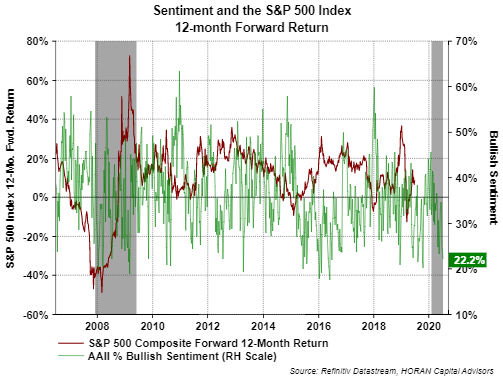

The next chart shows the 12-month forward return for the S&P 500 Index at the various sentiment reading levels. For the time period covered in the chart, when the bullishness reading is in the 20's, the average return for the S&P 500 Index is just over 12%. As a contrarian measure then, low bullishness readings tend to be a bullish indicator for stocks. One should keep in mind this positive return outcome is not a certainty as significant negative 12-month forward returns occurred at times in the 2008/2009 financial crisis.

In conclusion, it may be difficult to see the complete picture when bad news headlines attract readers' attention. Yes, there are uncertainties with the virus and this being an election year. The market will not move higher in a straight line, but on balance, recent data would seem to indicate the glass is half full versus half empty.

No comments :

Post a Comment