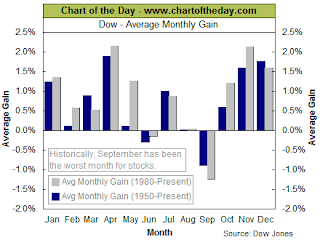

The market continues to struggle to find a firmer footing. As the below chart notes, September is living up to its place as the worst performing month for the market.

(click on chart for larger image)

Source: Chart of the Day

The situation at the moment is very fluid. The Federal Reserve seems to be sending a strong message that they will not bail out every mistake or financial institution ( Lehman). To have two of the oldest and most respected names on Wall Street (Lehman and Merrill) meet their demise in one day earlier this week and the government's infusion of funds ($85 billion) into the largest insurance company in the world (AIG) today certainly makes one take pause.

While one can argue with some of the logic and tactics from the government, there are some smart people working through these financial issues. The Federal Reserve has injected liquidity into the financial system--the most since 9/11/2001. The Fed's primary role is financial system stability. They will work to provide sufficient liquidity to work through this distress. Excessive leverage and financial engineering with real estate assets has created much of the problem. In addition, the advent of "mark to market" accounting has created short term pressure for financial companies that has exacerbated the situation. Although regulation can sometimes cause unintended consequences, it is clear that smart regulation is necessary to keep up with fast moving financial engineering. Most of the problems we are facing at the moment are almost entirely credit related.

Many have said these are unprecedented times. On the one hand, I would agree that the issues impacting financial firms seem unprecedented. On the other though, it wasn't too long ago that we experienced the technology bubble. During the deflating of the tech bubble, the Dow retraced nearly 40% of its value from 2000 to 2002. From a year ago, the Dow Jones Industrial Average is down 20%. I am unable to predict the future, but I do believe famed investor Warren Buffet might have said it best:

"I will tell you how to become rich. … Be fearful when others are greedy. Be greedy when others are fearful."-- Warren Buffett

Historically, many of these types of declines have proved to be great long term buying opportunities. Maintaining an overall philosophy of owning high quality companies and fixed income investments serves one well during difficult times. It is always important to maintain a disciplined investment approach during these times.

No comments :

Post a Comment