There is no denying the consumer has been a surprising bright spot during the pandemic. Government financial support programs have certainly contributed to favorable consumer sentiment. This positive sentiment is evident in last Friday's above expectation increase in month over month retail sales of 1.9%. Some may find it surprising that total retail sales are now above the pre shutdown level.

On a seasonally adjusted basis the only category of retail sales not experiencing an increase in August 2020 versus August 2019 is clothing and clothing accessories. The strength in sales has led to the retail inventory to sales ratio falling to an extremely low 1.23:1 level. If sales continue to see strength, manufacturing production will need to increase to replenish inventory levels as the U.S. moves into the holiday selling season. Even the manufacturing inventory to shipment ratio of 1.43:1 is down from its recession high of 1.7:1.

During the height of the virus mandated shutdown consumers continued to spend at non-store/online retailers; thus, making up for some of the decline in brick and mortar sales.. At the peak of the shutdown, online retail sales reached over 19% of total retail sales. As the economy has opened up, the percentage of online sales has fallen back to 15.3%, but still remains at a level higher than the pre-shutdown level.

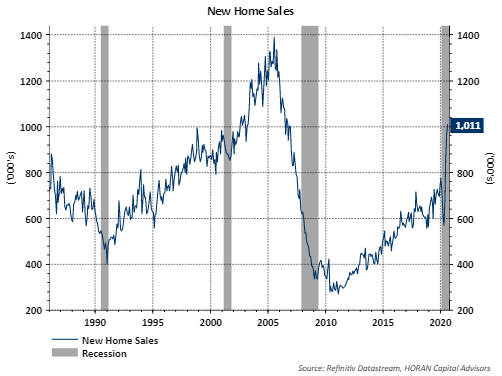

And just to highlight another area that provides confirmation of a consumer that is positive about their future prospects is in the housing market. I touched on this in a post about a month ago and the housing data has continued to show significant strength. The three charts below show:

- NAHB Homebuilder Sentiment of 83 is the highest level on record.

- August sales of new homes rose to an annual rate of 1.01 million units. NAHB notes, "inventory of new single-family homes for sale fell to a 3.3-month supply -- 40% lower than last year, and the lowest on record dating back to 1963."

Existing home sales rose 2.4% to an annual rate of 6.0 million units, far exceeding the pre-pandemic low of just under four million units. Homes for sale remain at a near record low of 1.49 million units. It certainly is a seller's market.

Given the strength seen in retail sales and strength in the housing market, these are sure signs of a confident consumer. With the consumer accounting for 70% of economic activity, economic growth into year end and next year is certainly on a favorable path.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.