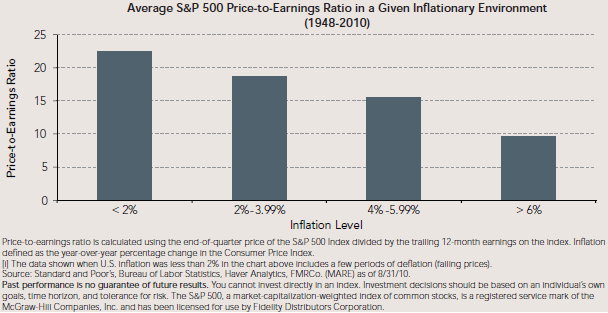

Of some concern at this point in time is what will be the future rate of inflation. The concern with inflation is its impact on the expected returns for stocks and bonds. For stocks, higher levels of inflation will reduce the value of future earnings since those future earnings will be worth less in present value dollar terms. Because of this lower value of earnings, one can expect the price to earnings ratio (or P/E) to contract. From an investment perspective this is will be a headwind for stock prices as PE multiples will tend to contract.

At HORAN Capital Advisors, we do believe inflation will be a factor investors will need to contend with in the not to distant future. This being the case, what impact might this have on stock returns and valuations going forward? As I have noted in prior posts, specifically, Inflation in the Pipeline and Relating Company Fundamentals To The Dividend Discount Model, inflation does have an impact on stock valuations. An important question then becomes what level of inflation can an investor expect and what will be the impact on stock valuations. At HORAN we do believe inflation will be an issue in the future that investors need to factor into their expected stock returns. We do not believe we will see an environment where we get hyper inflation though.

At today's valuations and moderate expected levels of inflation, stock valuations do seem to be trading at valuations levels below historical averages. Fidelity recently published a research article noting where stocks might trade at various levels of inflation.

At HORAN Capital Advisors, we do believe inflation will be a factor investors will need to contend with in the not to distant future. This being the case, what impact might this have on stock returns and valuations going forward? As I have noted in prior posts, specifically, Inflation in the Pipeline and Relating Company Fundamentals To The Dividend Discount Model, inflation does have an impact on stock valuations. An important question then becomes what level of inflation can an investor expect and what will be the impact on stock valuations. At HORAN we do believe inflation will be an issue in the future that investors need to factor into their expected stock returns. We do not believe we will see an environment where we get hyper inflation though.

At today's valuations and moderate expected levels of inflation, stock valuations do seem to be trading at valuations levels below historical averages. Fidelity recently published a research article noting where stocks might trade at various levels of inflation.

|

| From The Blog of HORAN Capital Advisors |

As of July 2010, year-over-year inflation stood at 1.3%, while the S&P 500’s P/E ratio (using trailing 12-month earnings) was 15.6 as of August 2010—somewhat below the index’s historical average (17.7).

Using earnings forecasted over the next 12 months (to August 2011) the market’s P/E ratio was 14.1 as of the end of August—also below the index’s long-term average. Thus, given the low current level of inflation and both trailing and forward-looking measures of earnings, the stock market’s current valuation is somewhat below historical norms.

Inflation becomes a more serious problem for investors if/when the economy begins to show better growth. Not that politics drives the economy; however, the policies coming out of Washington over the last two years have not been pro-growth. With a likely change in the control of Congress in November, sentiment and gridlock might be a positive attribute for higher stock prices and a stronger economy. Consumer and investor sentiment historically have had a strong influence on the economy and the market.

No comments :

Post a Comment