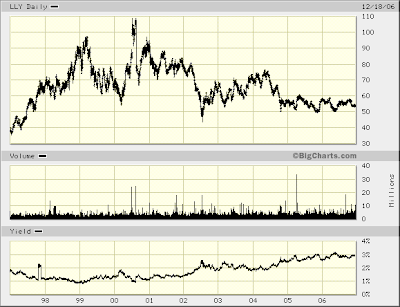

Lilly (LLY) announced a 6.2% YOY increase in its quarterly dividend today. The 5-year average payout ratio averages 51%. The payout ratio has trended higher during this period, with a low payout of 41%in 2002.

As noted in past posts, the dividend growth rate is a factor that receives a lot of weight in analyzing the potential growth prospects of a company. A dividend growth stock's long run return tends to match its dividend growth rate, all else being equal. Is Lilly's 6.2% increase an indication of slower growth for LLY? Following are two tables detailing some company financial information:

(click on charts for larger image)

LLY has continued to use cash through September 2006 with cash and short term investments totaling approximately $3.6B. So the question becomes is sufficient information available that warrants selling or purchasing the stock?

Additional key factors:

- high dividend yield over last 15-years equals 5% in mid 1994.

- low dividend yield over past 15-years equals .9% at the end of 1998.

- stocks appears to be making a bottom in the low $50's.

- Lilly has a fairly strong drug pipeline: Prasugrel (anti-platelet agent), an inhaled insulin drug, long acting version of Byetta (diabetes), and a cancer drug.

- FDA requiring additional Phase III study for the diabetic drug Arxxant

No comments :

Post a Comment